It’s the age old question for businesses looking for investment: who should we approach? Both angel investors and VCs have their merits but there are pros and cons for both and let’s face it there isn’t a one size fits all approach for investment. Rather this guide is designed to help you with some of the more obvious benefits of each. Who knows, you may end up having both on your roster of investors.

Let’s deal with the obvious

What defines an angel investor and what defines a VC? And did we mention there are a bunch of options in between?! Some VCs operate like angels and vice versa.

A typical angel investor

An angel investor is someone who provides personal financial backing for small startups or entrepreneurs, usually in exchange for ownership equity in the company. They can invest in different ways under this umbrella but often offer up their expertise to help the business grow.

"Just because an angel is investing in you off their own back, don't expect them to be any less sophisticated than a venture fund."

Larry Alton

A typical venture capitalist

A venture capitalist (VC) is a private equity investor that invests other people’s money in companies that have high growth potential in exchange for an equity stake. VCs are risk takers – many of the companies they invest in fail but the opportunity for a huge return on investment on one success makes it an attractive offer.

"Many entrepreneurs looking for funding from venture capitalists don’t know enough about the investment process. Although you need to showcase your passion when sharing your vision, this is not a time for selling the sizzle."

Allan Wille

VCs tend to get the limelight

In our experience the VCs of the world tend to get more of the limelight than angels. But don’t let that put you of angel investors have a lot to offer too!

It’s sometimes just a question of timing

Is it simply a question of how much risk the investor is willing to take regardless of angel or VC? It’s true to say that VCs are accountable further up the food chain to their own group of investors. Angels on the other hand are in the main investing with their own money which creates an interesting dichotomy, you would assume making them more risk adverse. But on the whole they tend to invest in projects when the risks are higher.

Perhaps a question for a future article?

Early stage

Series A, B ,C…Z

What does it mean for your start-up?

First and foremost, raising any kind of investment is very time consuming. Understanding the investment market and who does what, and when, is key to focusing your efforts. Time spent with an investor who isn’t suitable is time wasted. As we said earlier, understanding how the investment market works is key to running a successful round.

Knowing how investing works is key.

Playing a game is so much easier if you know the rules! Investing isn’t really any different, and understanding the process can make the difference between a successful round and a huge time-wasting exercise.

The value add, it’s not just about money

The purpose of any investment is to raise money to achieve a set of business objectives that in most cases wouldn’t otherwise be possible. The trade of is that the investor gets a share of the companies value in exchange. Sounds simple, but for most early stage companies achieving those goals is not solely a function of having cash in the bank. This in part explains why accelerators and funds that provide skills and service alongside cold hard cash often have a better hit rate than pure cash investments at the early stage, It’s no coincidence that accelerators like Y Combinator have spawned a myriad of successful start-ups. What it really means is that early stage start-ups lack more than just money and this is where experience and access to a wide network comes into play.

Angels understand your business

Besides my money, I make a commitment to give my knowledge and networks to the benefit of the company and founders I invest in.

Ari Korhonen

Very often angel investors will have real world experience of building a start-up business into a successful company. It’s become almost a cliche that successful founders become investors post exit. Now whether this qualifies them as savvy investors or not, or whether one successful start-up denotes the kind of expertise that is transferable to others is open to debate. But, it’s a commonly treaded path. Of course the most savvy angels have wide experience and a wide contact book and they’ve been exactly where you are. Having that on your board is invaluable. The best angels make a point of this, their real world experience, knowledge and contacts and their willingness to act not just as investor but as mentor can be exactly what your business needs especially at the early stages.

VCs have connections

OK, so angel investors have connections too, but in the main it’s hard to compete with a whole team of people. Many VCs have internal teams that can help on marketing, finance, operations, legal. It’s really just a question of scale with VCs operating at the larger end of the market a lot of this would be expected. That being said VCs aren’t there to run your business, in a lot of cases it’s a purely financial transaction it really just depends where your business is at.

What does it mean for your start-up?

It really is just a question of timing. Did we mention that already?! The value add is super important and certainly a factor in deciding on who to approach for investment but it requires caution. By definition approaching an investor because they have the skills to make a business idea work seems counter intuitive, rather the idea and traction needs to tell a story already otherwise it’s just a project and not a business.

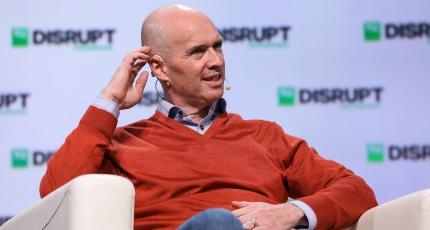

Meet the angel

Jason Calacanis epitomises angel investors. He’s got a varied business history having founded a bunch of successful and not-so-successful companies. Invested early in businesses like Uber and has written a very popular book on angel investing. He likes to get hands on with his investments and it’s fair to say he’s very well connected.

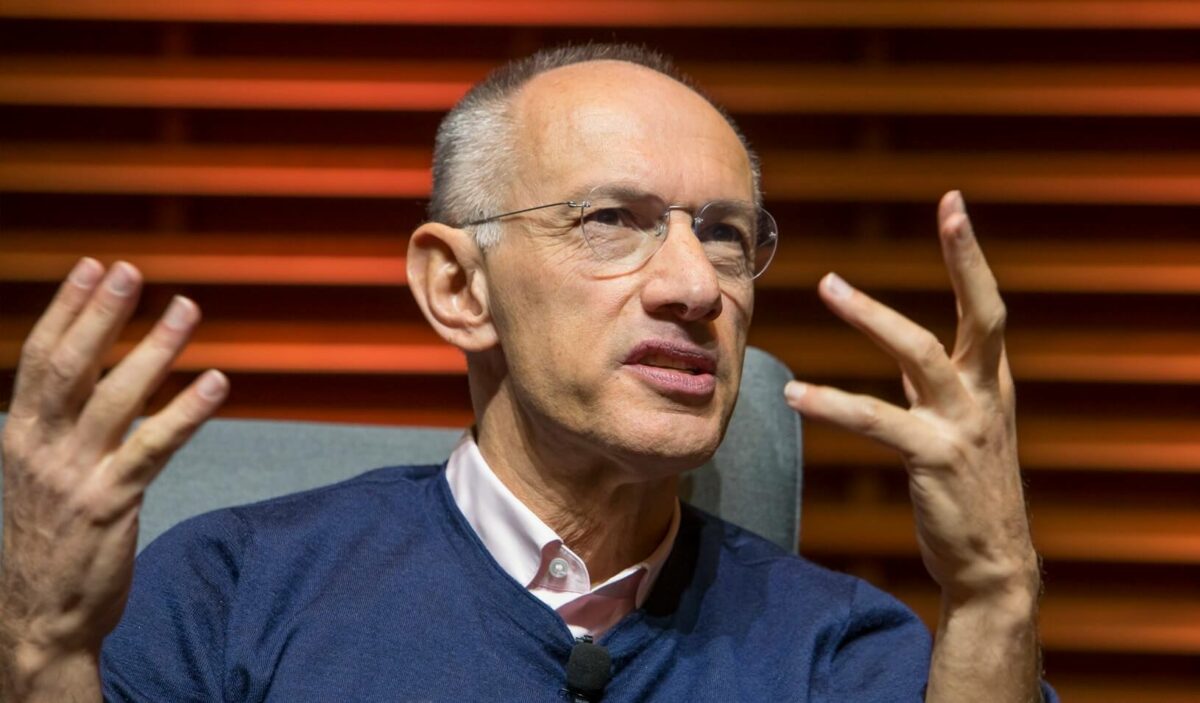

Meet the VC

As chairman of Sequoia Capital Michael Moritz needs little introduction. Google, PayPal, Stripe, the list is long. Michael actually started as journalist, joining Sequoia in the 80s. You’ll likely find him sitting at the board table of LinkedIn rather than our angel above, who’ll probably have his sleeves rolled up.

What does it all add up to?

It would be somewhat of a cop out to say one is better than the other. Our take is that it all comes down to how you’re grounded, personalities play such an important part especially at the early stages of a business venture. Investors are also buying much more into founders and ideas at this stage as opposed to proven and profitable. When you’re scrapping in the trenches it feels like you want someone who is going to scrap with you. By their own volition that’s not always a VC. But, start getting in right and the doors VCs can open and the broadening of horizons are exactly what will take you to unicorn land.

Everything you always wanted an investor to tell you.

Watch the latest in our investor interview series where Decksender’s Mike talks to Matthew Cushen of worth capital.